As many of our more seasoned clients know, Income Taxes are not supposed to be PAID during tax season but are supposed to be PAID throughout the course of the tax year. For example, if you generate $300,000 in net income (profits) during 2021, the tax on that income is technically supposed to be paid quarterly throughout 2021 AND NOT during tax season 2022.

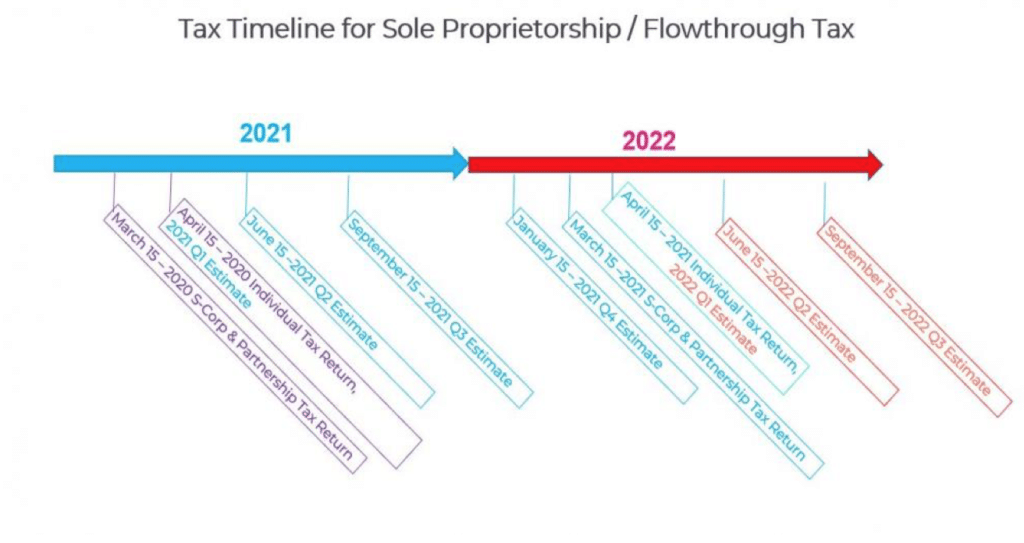

Tax Timeline

If you refer to the Tax Timeline above, you’ll notice that for 2021, there are estimated taxes that are due throughout the course of 2021. The purpose of the April 15th (2022) deadline is to file your tax return, which notifies how much income taxes you should have paid. If you have overpaid through your estimated tax payments, you will receive a refund from the tax authorities. If you have underpaid, you will have a balance due. For example, if you paid $30 per quarter in 2021 in total you paid $120 in estimated taxes. If your tax return says that you should have paid $100, you are entitled to a $20 refund from the tax authorities.

What if I pay late?

The IRS (or other tax authorities) may assess Interest & Penalties for any late payments. Currently. The IRS’ penalty is .5% of the total unpaid tax multiplied by the amount of months that the payment is late. For example, if you paid $100,000 but paid it 5 months late, your penalty would be $2,500 ($100,000 x .5% x 5 months)

Is there any way that I can reduce my estimated taxes without a penalty?

Yes – using the “Safe Harbor” method of paying your estimated taxes! The “Safe Harbor” method is the minimum threshold for which you won’t be charged interest and penalties. The IRS Individual Safe Harbor = The Lesser of:

o 110% of prior year actual tax or

o 90% of current year actual tax

For example, if your 2020 total tax was $125,000 and your 2021 forecasted tax is $200,000, as long as you pay total estimated tax payments of $137,500 (110% of last year’s tax liability) you can avoid IRS penalties and interest. PLEASE NOTE that using the safe harbor does not eliminate your taxes, it simply defers the tax payment until the end of the year. With an ecommerce business, we highly recommend that you do not use the safe harbor method unless you have the cash safely set aside to defer the taxes to a later date.

We view taxes as the highest risk to your business and we make it a priority to align taxes with your cash flows to the best of our abilities. When we send you the estimated tax emails each quarter, we encourage you to schedule a call with Chris & the team to ensure that you are fully up to speed on your individual tax situation.