Sales tax has completely changed over the past few years coming out of the South Dakota v. Wayfair decision. The Court ruled that ecommerce sellers are required to collect sales tax in each location where sales exceed nexus thresholds, even if they have no physical presence.

To make matters more complicated, each platform has slightly different sales tax processes, creating confusion in ecommerce accounting. In this article, we’ll break down everything you need to know about sales tax nexus as an ecommerce seller.

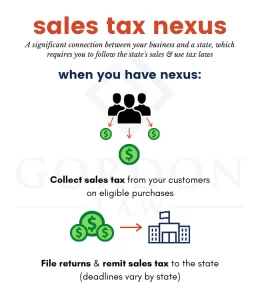

What is Sales Tax Nexus?

A sales tax nexus is a term used to describe a company that has a business connection to a state but no physical location. Each state will set an economic nexus threshold, which is the amount of sales that ecommerce sellers need to exceed to start collecting and filing sales tax. This is usually what most ecommerce sellers track to figure out their filing obligations.

For example, in California, ecommerce businesses have met the nexus requirements when they earn more than $500,000 in sales from within the state. Unfortunately, there are other layers of complexity in Shopify and Amazon accounting for sales tax nexus, including:

- Physical Presence – Before the South Dakota v. Wayfair ruling, this used to be the only factor determining sales tax obligations. A business has a physical presence if there are people and property within the state.

- Economic Nexus – An economic nexus can either be a certain dollar amount of sales sourced within the state or a specific number of transactions. For example, Connecticut requires sellers to have over 200 transactions and make more than $100,000 to trigger sales tax obligations.

- Click-Through Nexus – This type of nexus deals with in-state referral agent activities. If you make commission payments for website or marketing sales to a referral agent, you might have to pay sales tax.

- Affiliate Nexus – If you hold a substantial interest in an in-state retailer that sells a similar line of products, you might trigger this nexus.

As you can see, there are numerous ways that online sellers can trigger sales tax nexus, which makes ecommerce accounting crucial to know when it’s time to register and file in a state.

Steps to Determine Your Sales Tax Filing Obligations

Economic nexus will be the factor that ecommerce sellers need to pay close attention to. First, you need to be aware of the nexus thresholds in each state, including both sales and transaction thresholds. Next, you need to be sure your ecommerce accounting is properly tracking sales to each state.

It’s not uncommon for sellers to generate income from numerous platforms. You need to be sure you are tracking gross sales from each platform. If you track nexus independently on each platform, you might miss filing obligations. For example, if you only have $400,000 in sales to California through your Amazon platform, you wouldn’t need to file. Once you combine the $400,000 with the $200,000 earned from Shopify, you are in noncompliance.

This is why having a central ecommerce accounting platform is crucial. If you are unsure of how to track nexus across multiple platforms, seek out expert help. Keep in mind, you don’t want to rely on the sales tax trackers within each platform. You need to be tracking this data across your entire business.

How Sales Tax Responsibilities Differ by Platform

Adding another layer of complexity to sales tax nexus is the different procedures on each platform. Certain providers, like Amazon and eBay, are considered marketplace facilitators. This means that they are required to track, collect, and remit sales tax on your behalf. However, it can be helpful to still track sales to each state during your regular Amazon accounting tasks.

On the contrary, Shopify passes this burden to sellers. This means you will need to track your sales to each state. Once you meet the nexus requirements, you will need to register for sales tax, begin collecting tax from customers, and file regular reports. Compliance relies on having the proper backend Shopify accounting controls.

Summary

Which states have you met the sales tax nexus thresholds in? Remember, it’s illegal to start collecting sales tax from customers without registering first. If you are having trouble tracking your gross sales to each state or understanding when nexus is triggered, reach out to one of our team members.

We can help you manage your sales tax function, removing one thing from your growing to-do list. Reach out today to schedule your free consultation.